Current Vs. Noncurrent Asset: 3 Major Differences

To those of you who are acquainted with the world of Accounting, the terms current and noncurrent assets sure do sound familiar. However, from a layman’s point of view, these terms might seem puzzling at first.

But once you are done reading this current vs. non current assets comparison guide, these two words and their differences will be as clear to you as the day!

From the context of Financial Accounting, assets refer to all kinds of resources that a company acquires for running its day-to-day operations and for ensuring organizational growth.

These assets are further classified into current and noncurrent assets. This article focuses on bringing forth the numerous differences between current assets vs. non current assets.

What Is a Current Asset?

Therefore, to review, a current asset refers to any asset owned by a company that is easily convertible to cash within a year and is employed by the company to carry out its trading activities successfully.

For instance, a company selling tractors will have an inventory of tractors in their warehouse for sale, and these tractors can be converted to cash within a year.

So the tractors will be categorized as the company’s current assets in the balance sheet, and their values will be recorded at the market value.

What Is a Noncurrent Asset?

On the contrary, a noncurrent asset is a company’s long-term asset that cannot be converted to cash within a year and which works to fulfill the company’s future needs.

If we look at the very example of tractors, but this time for a company selling wheat, the entire example shifts, making the tractor the company’s noncurrent asset in this scenario.

To clarify, the company selling wheat needs to sow and reap the wheat from the land. Before sowing the seeds, the land needs to be made uniform for farming using the tractor.

A tractor serves multiple purposes in the agricultural field. Therefore, to the company, the tractor is a noncurrent asset that will remain in the business for more than a year and will help the company grow by serving it for an extended period of time while depreciating over several years due to the heavy use.

Main Differences Between Current Asset and Noncurrent Asset

To help you achieve a clear understanding of the parameters that set current assets apart from noncurrent assets, we have outlined their differences for you below!

Difference in Definition

Current assets are assets in a business that can be converted to cash within a year, whereas noncurrent assets are in the business for more than a year, and their values are not recognized until at least a year.

Current assets are considered to be cash equivalent and are inclusive of assets that enable the company to run its daily operations as well as to pay for the daily expenses.

Noncurrent assets, on the contrary, are categorized as long-term investments by a company, and their useful lives extend to more than a year. Noncurrent assets serve the long-term needs of a company by aiding in its growth.

Difference in Examples

Assets that are usually classified as current assets are cash and cash equivalents, accounts receivables, prepaid expenses, and inventories.

Cash and cash equivalents are pretty self-explanatory. Accounts receivables are the money owed by customers who have bought goods on credit from the company, so the company expects to collect it within a year.

Prepaid expenses are expenses that the company has paid for in advance even before incurring them to ask for the cashback at any given moment.

Lastly, inventories are stocks of goods that the company can liquidate at any time. They are all, therefore, convertible to cash within a year.

Noncurrent assets, on the other hand, are difficult to liquidate within a year. Examples include, but are not limited to, properties, plants, equipment, and goodwill.

These are all belongings in a company that have long, useful lives. They either depreciate/amortize and become obsolete over a period of time or are sold for exchange by the company after using them for more than a year.

Difference in Valuation

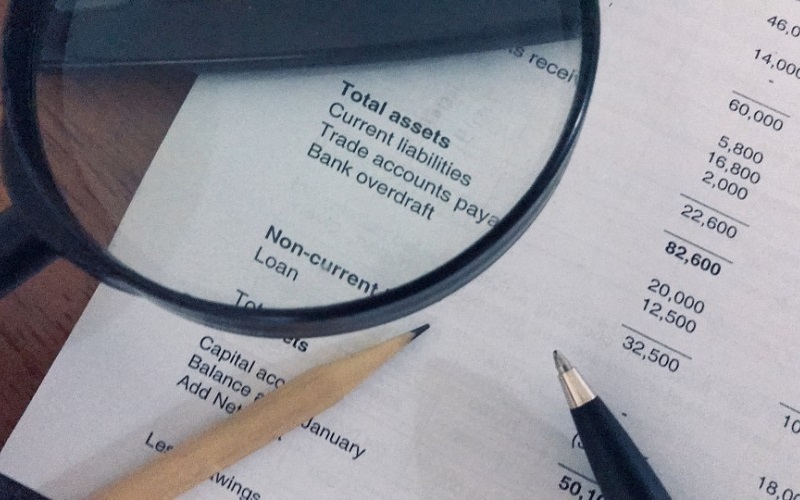

Current and noncurrent assets are also valued using different techniques while recording and reporting them on the company’s balance sheet.

Current assets are always valued at the current market prices. Their values on the balance sheet reflect the values that they would be worth in the market on that day if the company were to sell them.

However, noncurrent assets are valued at cost after deducting depreciation since they lose their value from wear and tear.

This is because, unlike current assets, noncurrent assets stay in the company for a long time. So companies spread out their costs over several years to paint an accurate picture of their consumption and value on the balance sheet.

Apart from these dissimilarities, current assets differ from noncurrent assets in numerous other ways. Their differences are outlined in a tabular format below for a clear and concise presentation!

Some Articles You May Want to Read:

A Comparison Table: Current vs. Noncurrent Assets

| Parameter of Comparison | Current Asset | Noncurrent Asset |

| Definition | Cash equivalent or convertible to cash within a year | Not converted to cash within a year |

| Usage | Funds a company’s short-term or present needs | Funds a company’s long-term or future needs |

| Examples | Cash, accounts receivables, inventories, short-term investments, prepaid expenses | Land, equipment, goodwill, patents, trademarks, long-term investments |

| Valuation | At market price | At cost less depreciation |

| Tax Implications | Profit or loss from the sale of current assets results in income or expense from operations, so no tax is imposed | Profit or loss from the sale of noncurrent assets results in a capital gain or capital loss, where tax is imposed on capital gains |

| Revaluation | Not usually revalued, however, in specific scenarios, inventories are revalued | Need to be revalued periodically to adjust to market values |

Conclusion

To conclude, every company in the world possesses both current assets as well as noncurrent assets. The categorization of the assets, however, depends on the line of business of the companies.

An asset classified as a current asset for one company might serve as a noncurrent asset in another, as exhibited in the article through the tractor example.

If you read and comprehend our current vs. non current assets article thoroughly, identifying the differences between them will definitely be a piece of cake for you!