5 Differences Between Gross and Net – Comparison Table

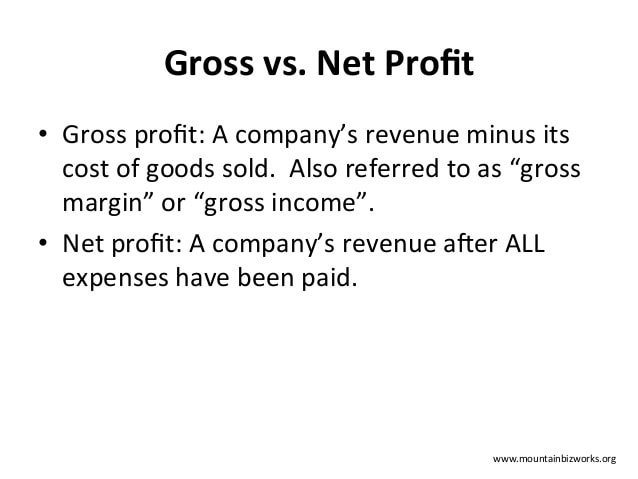

When in business you will hear the terms gross and net used often. These two terms are related, but they are not the same thing. Gross is the whole of something whereas net is a part of the whole after some kind of deduction.

What is the Gross?

It is the total amount made such as total profit or total sales. This is without any deductions being made. People who are on salary pay income tax on their gross income. This is because of the Income Tax Act of 1961.

GDP Vs. GNP: What Are The Differences?

What is the Net?

It is the amount that is left after all deductions have been made. It starts with the gross and then subtracts all deductions such as production cost and advertising. Self-employed people and businesses pay taxes based on their net income. This is also because of the Income Tax Act of 1961.

Calculating Gross and Net Income

Gross income = cost of goods sold – revenue

Net income = (expenses + interest payments + taxes) – gross income

Watch the below video explaining the differences between gross income and net income:

Gross and Net Margins

- Gross margin is the gross income presented as a percentage of the revenue.

- Net margin is the net income presented as a percentage of the revenue.

Gross Weight and Net Weight

- Gross weight is the actual weight of the product plus the weight of the packaging.

- Net weight is actual weight of the product without any of the packaging.

Recommended for You:

Gross Vs. Net Differences

Here is a simple comparison table depicting the key differences between gross and net.

Gross |

Net |

|

|

|

|

|

|

|

|