Current Vs. Fixed Assets: How Do They Differ?

There are numerous assets in accounting. A company can use these various genres of assets to make profits, pay debts, and the list keeps ongoing.

However, in reality, assets are of two types, and all the other assets that an economic or business entity uses to do their work branch out from these two: Fixed Asset and Current Asset

Nevertheless, even though these two categories are assets, both of them have very different purposes.

So, we took it upon ourselves and provided you with fixed assets vs. current assets guide, which compares and gives you a smooth and swift explanation of the difference between the two and how they operate.

Thus, allowing someone to handle finances more efficiently.

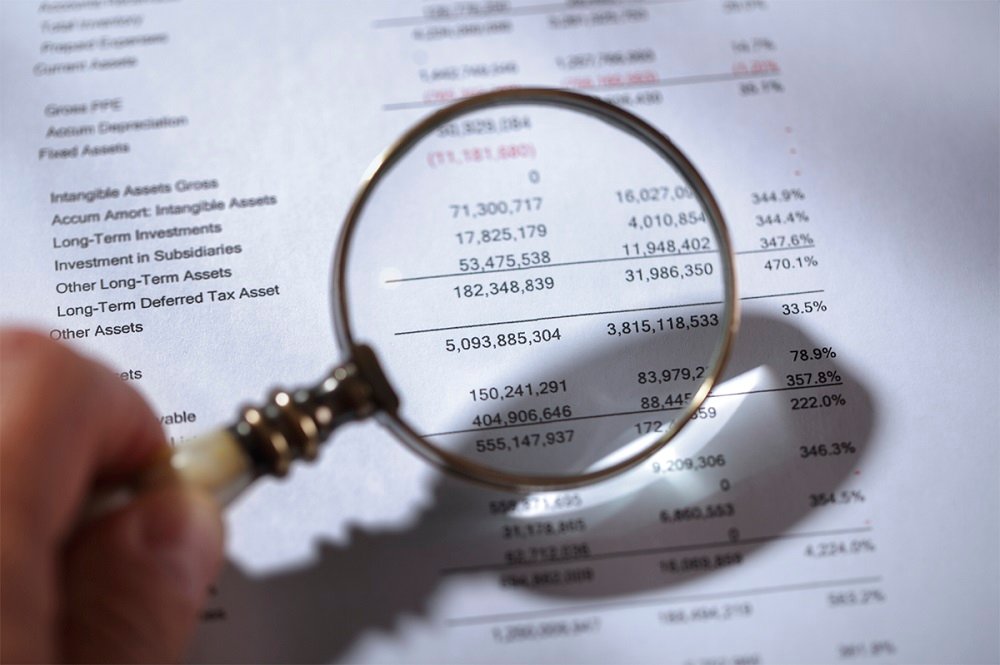

Current vs Fixed Assets: A Comparative Table

The current vs. fixed assets table puts these two accounting topics against one another and helps you see the big difference between them. So, without any delay, let’s get going!

|

Features to Compare |

Fixed Assets |

Current Assets |

|

Meaning |

Fixed assets are long-term assets. Now, what are long-term assets? If you are running a business, you would need an office or factory, or shop. So, you go and buy all of these or anything. Once you have made the purchase, you will not get the returns immediately and attain the benefits over time. These are long-term assets |

These are a form of short-term assets. Allow us to give you a simple example of current assets. If you produce pens, then it is reasonable to deduce that your product will be pens. Upon selling your merchandise, you will be receiving benefits immediately. Due to the instant advantages granted by this asset, it is called a current asset |

|

Fluid Cash |

A long-term asset or fixed asset does not provide a fluid flow of cash |

Current asset or short-term asset does grant a fluid flow of cash |

|

Value |

A fixed asset is valued by deducting the depreciation from the overall cost |

We calculate the current asset by deducting the cost from the market price |

|

Holding period |

Over a year |

A couple of months |

|

Example |

Fixed assets are generally products that an entity attains without the thought of selling them instantaneously—for example, Land, Delivery Transport, Office, Factory, etc. |

Current assets are conventionally small transactions. The best example of a current asset is a pencil. In this case, you are a pencil manufacturer; your product asset and the raw materials used to make a product are your current, which you can use to provide the liquid cash flow. |

|

Affects in Business |

Generally, long-term assets do not have a direct influence on a business daily. |

Current assets have a massive influence on your business. |

Fixed Assets

Allow us to give you a small walkthrough of all the information provided in the table. Here we shall be giving you a simple summary of all the data that we have given you.

With the help of this section, understanding everything regarding the topic should be a very effortless task.

Definition

We will start with a bookish meaning, ‘properties bought for longstanding usage and are unlikely to be transformed swiftly into cash.

Examples include buildings, land, delivery vehicles, equipment, etc. In short, products that are attained with the intention of not selling them or for short-term usage are fixed assets.

Valuation

Fixed assets are included in the balance sheet. In the balance sheet, they are calculated or estimated after the depreciation has been taken into account.

Every fixed asset has to depreciate. You should know that the initial price of a fixed asset will fall after you have made the purchase.

So, you have to deduct the depreciation from the total cost of the fixed asset every time.

Liquification

Liquid cash is conventionally considered as the basic availability of cash. But, in the case of fixed assets, it is not very good.

Whenever you purchase a fixed asset, you plan on using it for a long time (at least above two years).

Thus, you cannot expect to convert it into liquid cash unless you upgrade or need the money for dire reasons.

Difference between Asset Management and Hedge Fund

Current Asset

Since we have provided an easy-to-understand walkthrough for fixed assets, it is time that we do the same for the current asset. Also know the difference between current and non-current assets.

Definition

Current is more like a short-term asset. What are current assets? Give us the chance to enlighten you!

Well, anything that you expect to sell and attain money is considered a current asset. Briefly stated, anything that will enable you to establish a liquid flow of cash can be deemed as a current asset.

Valuation

The current asset is also placed in the balance sheet. However, the calculation is a tad different for this type of asset. Instead of depreciation, the total price is deducted from the cost or market value.

Main Differences between Current and Fixed Assets

If you have come this far, you should have good knowledge of the difference between the two. Are you wondering why do you need to understand the classification between the two?

Well, if you have a good understanding of the difference between the two terms, learning and making accounting decisions would be easier.

Anyways, here is a quick walkthrough between real assets vs. financial assets. For your information, a real asset is a fixed asset, and a financial asset is a current asset.

- A real or fixed asset cannot be converted to liquid cash (easily). The current or financial asset is transformed into liquid cash without much effort.

- A current asset is a short-term asset, while a fixed asset is a long-term one.

- The fixed asset does not have a direct influence on your business. However, the current asset has a direct effect on your business.

Final Words

If you have come this far, you should have a profound understanding of what is a current and fixed asset.

In our article, we have matched current and fixed assets against each other. But there is no winner of the fixed assets vs. current assets debate.

Instead of showing the better option, you are granted relevant information that will help you make a superior financial decision.