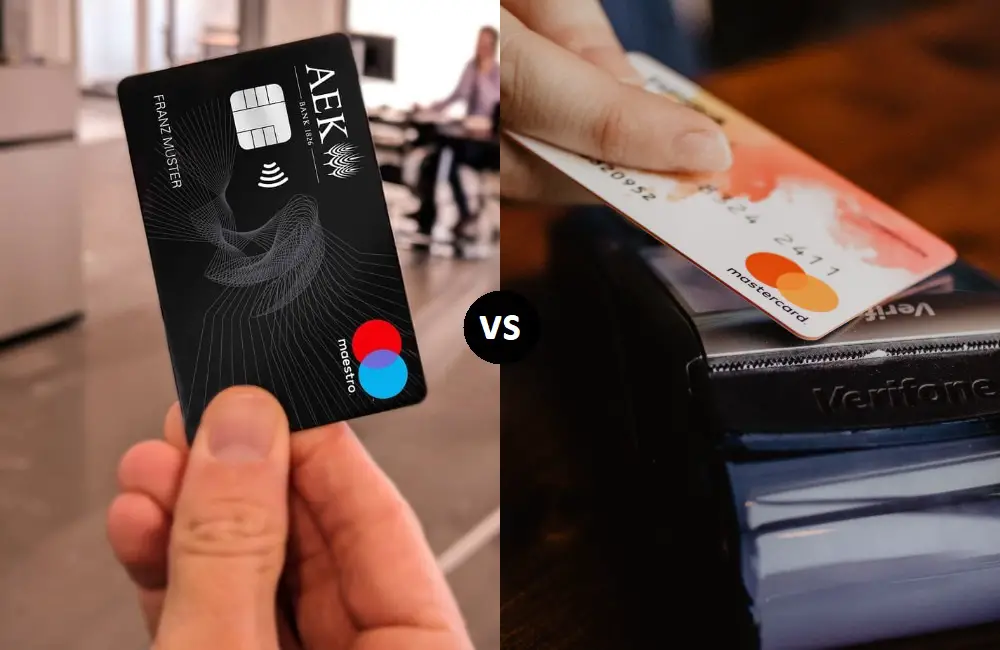

Difference Between Maestro Card and MasterCard

While making transactions, we often come across the usage of Maestro Card and Mastercard. Despite both cards being registered cards of the same company, they serve very different purposes.

To help you better grasp what these cards are used for, here is our take on the difference between Maestro Card and MasterCard.

Maestro Card vs. MasterCard: An Overview

Both Maestro Card and MasterCard can be used to withdraw money using an ATM, so using either will save you from the trouble of lugging around cash.

While Maestro Card can be used only as a debit card, you get to choose whether you want to use your MasterCard as a prepaid , debit or credit card.

You can use both cards globally in a retail store; however, MasterCard is more popular and widely used worldwide. You can even get reward points after the transaction you make using a MasterCard.

What Is a Maestro Card?

Maestro is a brand that offers both debit cards and prepaid cards that are owned by MasterCard. To own a prepaid card, you will not have to open a bank account as the amount of money on the card has already been paid for.

As for the debit cards, they are connected to a bank account one currently owns. You can withdraw and make a transaction with the amount of money you already have in that specific bank account, as the card is a debit card. Interest is not charged at that amount of money.

You can simply swipe the card at any point of sale, including ATM booths where you can withdraw money easily. The company will confirm the payment once the cardholder confirms the PIN or signs the receipt.

What Is a MasterCard?

MasterCard was known as Master Charge till 1979, and before that, it was known as the Interbank at the time of establishment. Due to the various purposes it serves, it can be used in over 200 countries.

As you can use it as a credit card, the limit for the credit card might vary on different factors, including income of the cardholder, monthly transections, spending factors.

There are also various types of MasterCard offered, ranging from World, Standard, to Platinum. And usually, the transaction reward points you get after every transaction play an important role in raising the status of your card.

Visa Vs. Mastercard: What Are The Main Differences?

Main Differences Between Maestro Card and MasterCard

- Maestro card can only serve as a debit card, while MasterCard can be used as a debit card, credit card, and prepaid card.

- Maestro card usually charges a lower rate of interest than MasterCard.

- As a Maestro card is a debit card, you can only use the bank you already have in your bank account. The limit for MasterCard differs as it also functions as a credit card.

- Maestro Card requires a PIN to make transactions, while MasterCard requires a signature.

Maestro Card vs. MasterCard: The Comparison Table

Below is a comparison table of Maestro Card and MasterCard to help you learn the differences at a glance.

|

Parameter of Comparison |

Maestro Card |

MasterCard |

|

Card Type |

Debit Card |

It could be a debit, credit, or prepaid card |

|

Transaction |

Confirmed through maestro PIN |

Confirmed through signature |

|

Limit |

Similar to the bank account balance |

Can vary |

|

Universality |

Globally used at retail stores |

Most commonly accepted and used |

|

Interest Rate |

Comparatively lower |

Comparatively Higher |

Credit Unions Vs. Banks: Key Differences You Simply Can’t Miss

Final Words

Both cards offer separate services and cater to customers’ different demands due to the difference between Maestro Card and MasterCard.

However, if you are looking for the most widely accepted card to make transactions wherever you are, MasterCard would be the best solution for you.