Fiscal Vs. Monetary Policy: What’s The Difference?

In a market economy, policy makers basically have two main tools to influence a countries’ economic activity and growth: monetary and fiscal. They both seem to have the same purpose, but what’s the difference between fiscal and monetary policy? Let’s analyze both concepts in detail and see what they mean and what sets them apart.

Fiscal Policy

Fiscal tools are numerous and always debated by economists, politicians and political analysts. Basically, they are the policies used by the government to steer the total level and/or composition of spending in a nation’s economy. Most often, this means changing either government spending or tax levels to promote economic growth or reduce inflation.

For instance, if the country is going through a recession, its government can borrow money and increase investments in infrastructure, thus injecting money into the nation’s economy and creating jobs. They can also lower taxes to encourage business activity and, ultimately, help the country get out of recession.

On the other hand, if a country’s government notices that the fast economic growth is causing inflation to rise in a worrisome manner, they can reduce government spending and set higher taxes to slow business activity and reduce expansion (thus keeping inflation under control).

Difference between Capitalism and Mercantilism

Monetary Policy

Similarly to the fiscal tools, monetary policies generally aim to either stimulate economic growth or slow down expansion to keep inflation at a “comfortable” level. However, they are set by the monetary authorities in the country, such as the Federal Reserve in the US or UK’s Bank of England, and they most commonly entail controlling bank reserve requirements or base interest rates.

For instance, setting lower interest rates can make borrowing less costly and thus promote investments and consumer spending.

Open market operations can also be carried out, by selling and buying government bonds, to either inject or pull money out of the economy.

Recommended for You:

The Differences between Fiscal and Monetary Policy

Now that you have a better understanding of these two essential economic tools, let’s put them side by side to see exactly what makes the difference between fiscal and monetary policy.

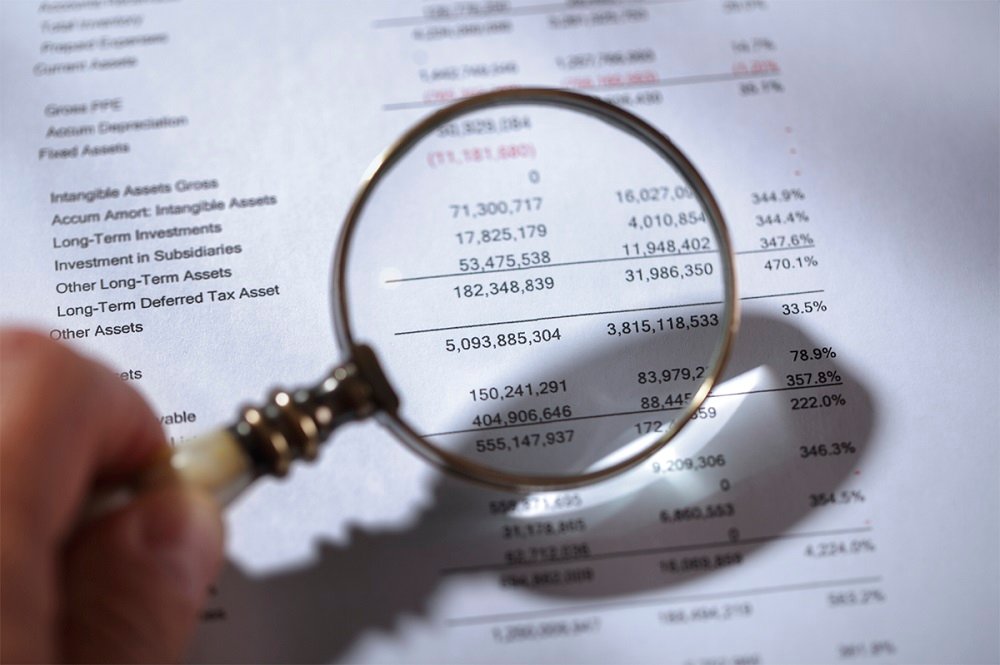

Fiscal Policy |

Monetary Policy |

|

|

|

|

|

|

|

|

|

|

Liked our post on the differences between monetary and fiscal policies? Subscribe to get more interesting articles about economics, finances and politics, as well as other fascinating topics, from biology to IT.