4 Key Differences Between HMO And PPO

You may have heard of those two terms circulating around in any health-care insurance discussion, and chances are you’ve fallen into an endless loop of indecision.

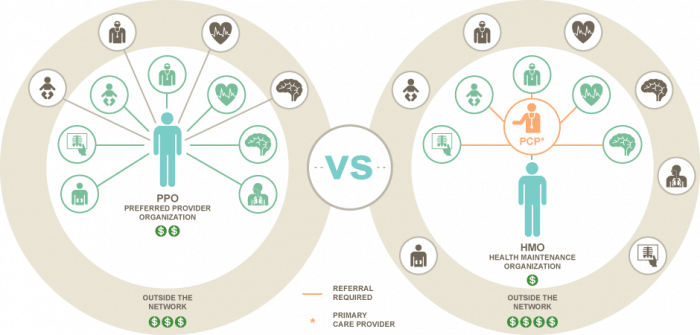

So what are the differences between HMO and PPO? Here are the things you need to know in order to formulate a well-rounded decision concerning your choice of health-care services.

What is HMO?

The Health Maintenance Organization (HMO) is a branch of managed health-care services. This plan is considered to be generally inexpensive, and that can play a major component in your contemplation; it offers lower premiums and/or copayment. This fact, however, is rather balanced out by the limited health-care providers’ access.

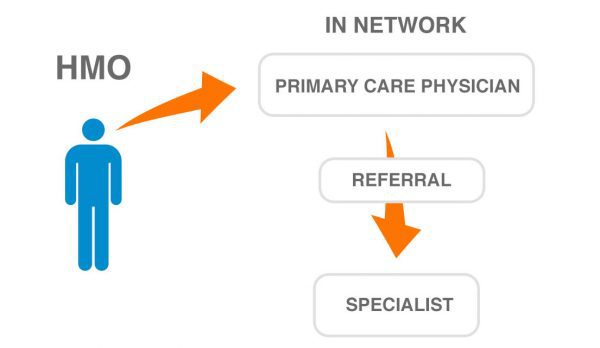

Members are enabled to pick their physician of choice granted he/she is listed among the approved health-care providers, and they are only able to see their provider if they’re given a referral from their primary care physician (some people refer to him as their gatekeeper)

This gatekeeper pretty much surveys your health care options in order to help you find the treatment you need. HMO covers various surgical treatments, x-rays, various types of screenings, laboratory tests, etc.

The Differences Between Registered Nurse(RN) And LPN

What is PPO?

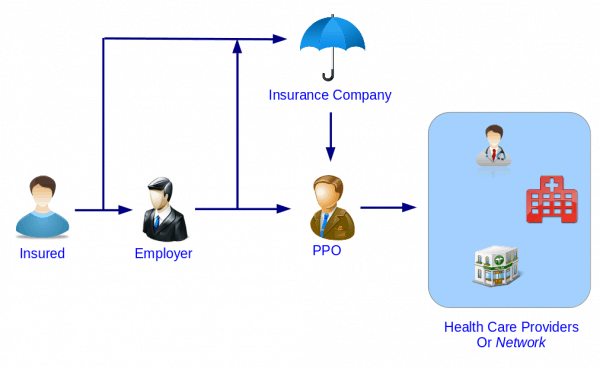

The Preferred Provider Organization (PPO) is also a managed health-care plan that aims at providing people with the best offers they can get from medical services. The difference is, however, that PPO offers its members a wider range of health-care providers to choose from and is generally more expansive.

In a somewhat proportional manner, this variety of choice comes at a price; you are typically expected to pay higher premiums and higher copayment for your service with the PPO plan. A monthly or quarterly premium is paid in exchange for the coverage of multitudinous medical services.

Unlike HMO, PPO allows for a somewhat free approach concerning members and their physician of choice. There is no need for a primary care physician, and members are able to take it upon themselves to choose and refer to providers alike.

PPO services are thought to be more flexible than those offered by HMO, but PPO members tend to stay within an out-of-pocket environment where office visit payments, higher premiums, and higher copayment are to be taken into consideration.

Recommended for You:

- Medicare vs. Medicaid: What are the Differences?

- Inpatient Vs. Outpatient: What Are The Main Differences?

- Credit Unions Vs. Banks: Key Differences You Simply Can’t Miss

Differences Between HMO and PPO

We’ve compiled the major key differences here in the HMO vs. PPO comparison table shown below

HMO |

PPO |

| Stands for Health Maintenance Organization (managed health-care plan) | Stands for Preferred Provider Organization (managed health-care plan) |

| Is considered to be a rather inexpensive option | It can pose a financial problem as it is more expensive. |

| Is slightly limited when it comes to the list of health-care providers | Offers a diverse platform from which you can choose your provider |

| Requires the presence of a primary care physician (gatekeeper) who directs your choice | Doesn’t require a primary care physician; members refer to their providers themselves |

Both HMO and PPO plans are meant to provide you with the best deals and discounted medical care services, but it is important to form a full understanding of what each plan has to offer in order to choose the perfect health insurance that meets your condition.