Credit Unions Vs. Banks: Key Differences You Simply Can’t Miss

Most people have an account that they use to keep their money safe so they can access it to pay bills and go shopping.

There is a wide range of options when it comes to opening an account, but choosing a credit union or bank can influence what you get out of your account. The main differences between banks and credit unions are in company legal status and rights/status of customers.

Credit Union

The main difference between credit unions and banks is that people who have an account at a credit union are members of the institution. That means they have a vote in electing board members and could also choose to be on the board.

A credit union is a non-profit establishment, which means they are able to provide their account holders with lower loan rates and higher savings interest rates. Their main focus is consumer savings. Most credit unions share the resource with other credit unions, which gives you optimum access to them and gives you additional savings.

Credit unions ensure their accounts up to $250,000 and are backed by the federal government. As a member of a credit union, you can open both checking and savings accounts, secure loans for homes and other purchases as well as other services traditionally offered by banks.

People who use a credit union often have to travel to a specific branch to make deposits or withdrawals and to use an ATM without having to pay a fee.

Debit vs. Credit: What are the Differences?

Banks

Rather than being a member of a bank, someone with an account is called a ‘customer’ and has no ownership in the institution. Banks are owned by investors and they do not have to have an account at the bank to have ownership.

Stockholders own and operate a bank and the number of votes they have depends on the number of shares they own. Customers are not offered any say in the operation of the bank and do not get to vote or hold a position on the board.

Board members are paid and are often chosen by the director rather than being elected. Banks are open to the general public and operate to make a profit. Banks focus on savings and checking accounts as well as other services that make the bank a good amount of money.

Banks usually do not share resources because they are working to make money, which means they are in competition with each other. Banks insure up to $250,000 and are backed by the federal government. Many times, account holders must pay a fine to use an ATM not owned and operated by that specific bank.

Recommended for you:

- Equity Vs. Assets: What Are The Differences?

- Difference between Accumulated Depreciation and Depreciation Expense

- 5 Differences Between Gross and Net

- Visa Vs. Mastercard: What Are The Main Differences?

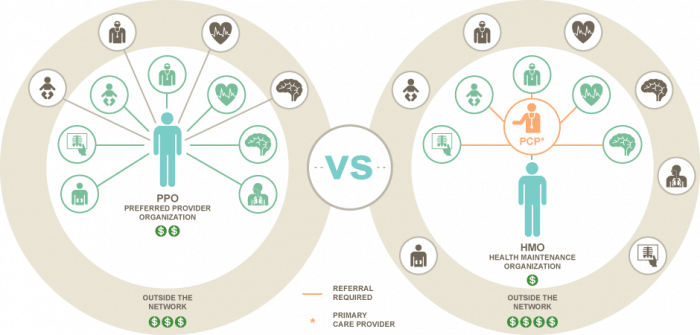

Difference Between Banks and Credit Unions

Below are the key issues shown by a bank vs credit union comparison table in which banks and credit unions differ.

| Parameter for Comparison |

Bank |

Credit Union |

| Account holders are members | No | Yes |

| Account holders on the board | No | Yes |

| Operated to make profit | Yes | No |

| Offers services to make money | Yes | No |

| Insured up to $250,000 | Yes | Yes |

| ATM fees | Sometimes | Sometimes |

| Many branches | Usually | Not always |

| Open to the general public | Yes | No |

If you still have confusion or want to clarify more – watch the below video

Have you enjoyed learning the differences between credit unions and banks? We hope so and invite you to sign up to our newsletter for more interesting articles.